Invoice Finance

It is possible to release up to 90% of money owing and it can be accessed in as little as 24 hours of raising invoices.

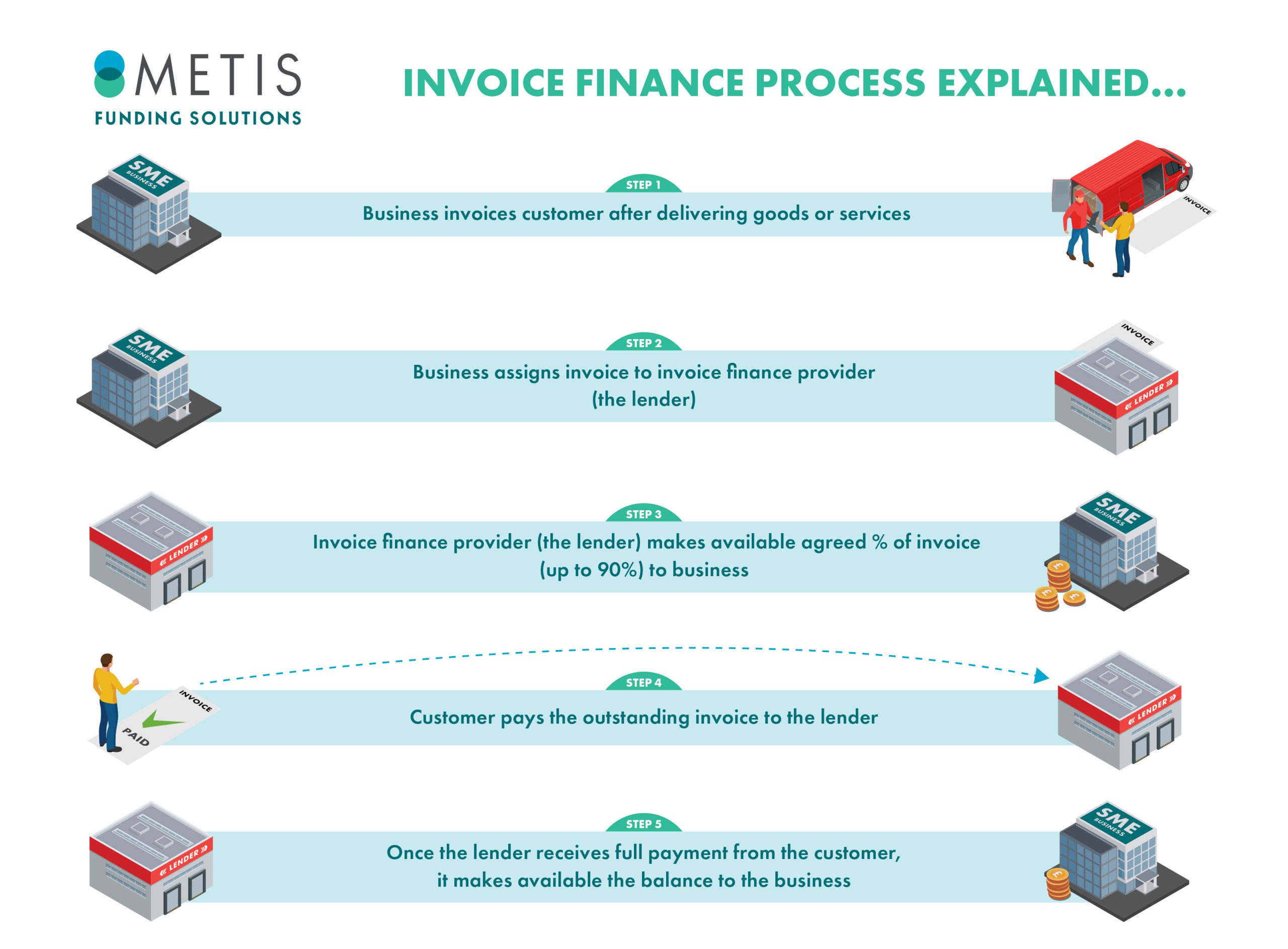

Invoice finance is the ability to provide cash flow for your business either by factoring or invoice discounting outstanding customer invoices.

The primary difference is that a factoring arrangement manages the credit control function for you whilst invoice discounting leaves you in control of this aspect.

Why use invoice finance?

Factoring is often a choice for small businesses who lack sufficient resources to manage credit themselves

Types of invoice finance

Invoice discounting is generally the better option for companies that have adequate resources in-house. Invoice finance is an increasingly popular choice for businesses in need of cash due to its flexibility and can help without you having to look to bank loans or extensions to credit terms.

The capital generated by the business itself is the source of the cash received and instead of waiting 30 days or longer to be paid the business may receive up to 90% of the money due within 24 hours.

Businesses large and small can benefit tremendously from increasing working capital through invoice financing or discounting. Both can be used to generate growth for the business.

The advantages of invoice finance include:

- It can dramatically improve cash flow giving you access to invoice value within 24hours

- You decide whether to handle your own credit control and sales management function or outsource to a dedicated team

- You unlock cash you have already earned

- You decide the level of confidentially best suited to your business needs

Invoice Finance explained…

Looking for expert financial guidance?

Great! Let's talk...

Durham Retail Displays Ltd

G United LTD

David has assisted me in moving forward in the correct direction with my businesses. I would not hesitate to recommend working with MFS, who listen to your business requirements and support you through your chosen route for your business

Willowdale Ltd

Since working with MFS, they have helped me to obtain funding for my properties in a very prompt timeframe..

I highly recommend MFS if you’re wanting to sit down with genuine people who take on board your personal circumstances. Ultimately, I will be using Dave & Paula for all my financing requirements for the foreseeable future and can't speak highly enough of what they have done for me.

Yorkshire Rendering Company

I explained my business requirements in brief. A face to face meeting was arranged at a time to suit, so that my requirements could be discussed in more detail.

I was met with professionalism, courtesy & a very friendly approach. If you require a solution to your business needs, I would highly recommend speaking to Metis.

Starboard Personnel

I would highly recommend Metis Funding Solutions, if you need help sourcing the best funding solution for your businesses with honest and helpful advice. Both Paula and David who we dealt with are very professional and very knowledgeable.

DJT Services