Small businesses are a vital part of the UK and its economy. Of the 5.9 million private sector businesses across the country, 99% are small to medium sized, with fewer than 250 employees.

As this suggests, each year thousands of people are taking the plunge and setting up on their own. According to the House of Commons Business Statistics briefing paper, in 2018 there were a grand total of 381,000 ‘business births’.

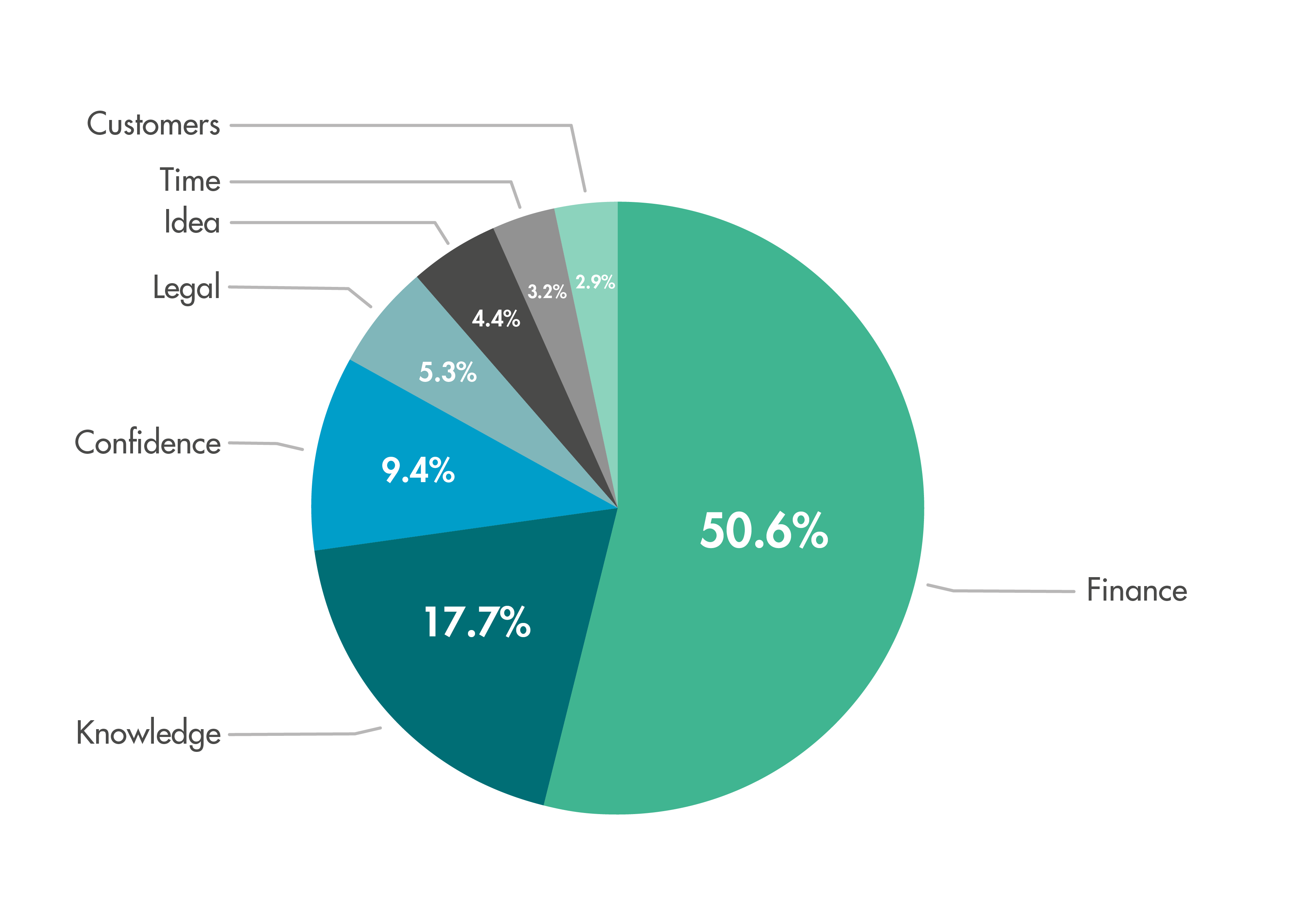

Behind each one of these lies a story – and often this is dominated by finance. Data collected on the startups.co.uk website between September and October 2019 revealed that the main barriers to entry for new business start-ups are:

This comes as no surprise to us at Metis Funding. We see evidence of finance being an overwhelming barrier for start-ups on a daily basis. Many people approach us with a great business proposal and the necessary knowledge and skills, but don’t know how to access funding. Debbie’s experience is typical: “I had a great idea and knew I had the experience and contacts to get started, but I was held back by financial fear. I ended up saving for two years and still working part time when I first set up the business.”

Self-financing v external

So what are the alternatives? Should SME start-ups wait until they have enough funds of their own before going into business? And when does it make more sense to seek external funding?

There is no definitive answer: much depends on the type of business you’re looking to launch.

If you’re a contractor and want to branch out on your own, self-financing is often viable and positive. The key is to find enough work to keep you going while you look for bigger contracts, taking care not to overstretch yourself. Think creatively about how you can keep your initial overheads down. If you need equipment, can you hire it or buy it second hand? Can you work from home instead of paying for an office? If you need somewhere to meet clients, can you hire a meeting space? Can you still be employed part time? If you’re funding the start-up yourself, slow growth and control are essential.

However, if you’re setting up a business such as a manufacturing company or print firm – with premises, equipment, materials and staff to pay for from the outset – self-financing is likely to be tricky.

In this case, where should you seek start-up funding?

While the bank may be your first port of call, the majority of banks now want charges on property when you borrow money and, unsurprisingly, many people are unwilling to put their house on the line. This may be behind the fall in the number of overdrafts and loans that banks are making to SMEs. According to Ernst & Young’s The Future of SME Banking report (2018), the number of approved overdrafts fell from 212,000 to 119,000 between 2012 and 2016, while the number of new loans for SMEs fell from 112,000 to 84,000.

Finding outside investment is difficult. Venture capitalists offer funding in return for equity, but most venture capital firms want to invest in proven businesses rather than start-ups. In addition, many new business owners are unwilling to sell shares before they’ve even begun trading.

Crowdfunding has become high profile in recent years, however the criteria for start-ups have become tougher and businesses often need a two-year trading history before being eligible. The ordinary people behind crowdfunding are unwilling to invest their money in a business without the security of a track record.

Invoice financing can be a useful tool for new businesses, but is only an option once you’ve started trading and if transactions are business-to-business.

The BEF alternative

At Metis Funding, we’re increasingly steering our clients who need start-up funding towards Business Enterprise Fund (BEF) loans.

BEF is a not-for-profit social enterprise, set up to provide loans to small and medium-sized businesses. Founded in Bradford, West Yorkshire, it began lending to businesses in the local area to encourage growth in the economy and job creation. It has now spread across the north of England and has a special scheme to lend money to start-ups.

The Fund is an official delivery partner for the Start Up Loans Company, a government-backed initiative designed to help businesses start up and grow. Our advisors at Metis can help you apply for up to £25,000 funding per director, with terms up to five years. It’s important to recognise that this is a personal loan – you’re borrowing money to put into your business. Loans are unsecured and fixed at 6%, with repayments unaffected by interest rate changes. We’ve been impressed by the personal, tailored service BEF offers our clients, backed up by support from experienced business mentors.

If you’re looking to start up a new business but are being held back by financial concerns, don’t hesitate to get in touch with us at Metis Funding. We can provide expert, no-nonsense advice and help you secure the funding you need to make your business fly.

Published: February 15